-

×

SFQ 24 Step Bridge to Level 5 - Spring Forest Qigong with Master Chunyi Lin

1 × $30.80

SFQ 24 Step Bridge to Level 5 - Spring Forest Qigong with Master Chunyi Lin

1 × $30.80 -

×

Getting Things Done Training Course | Crucial Learning By David Allen

1 × $30.80

Getting Things Done Training Course | Crucial Learning By David Allen

1 × $30.80 -

×

The 5K Club By Krista Dickson Education

1 × $30.80

The 5K Club By Krista Dickson Education

1 × $30.80 -

×

Being and the Meaning of Life (Diamond Heart, Book 3) By Hameed Alis

1 × $6.00

Being and the Meaning of Life (Diamond Heart, Book 3) By Hameed Alis

1 × $6.00 -

×

SET OF 6 WORKBOOKS: Sacred Geometry (All Ages) - Jain 108 Academy - Digital Download

1 × $30.80

SET OF 6 WORKBOOKS: Sacred Geometry (All Ages) - Jain 108 Academy - Digital Download

1 × $30.80 -

×

How To Bounce Back Digital Bundle By John Demartini

1 × $30.80

How To Bounce Back Digital Bundle By John Demartini

1 × $30.80 -

×

The Awesome Therapist Online Course By Derek Chapman

1 × $30.80

The Awesome Therapist Online Course By Derek Chapman

1 × $30.80 -

×

SJG Trading - Butterflies Class By Steve Ganz

1 × $30.80

SJG Trading - Butterflies Class By Steve Ganz

1 × $30.80 -

×

2 DAY: Conservative Management of Sacroiliac Joint Dysfunction & Hip Impingement By Kyndall Boyle - PESI

1 × $30.80

2 DAY: Conservative Management of Sacroiliac Joint Dysfunction & Hip Impingement By Kyndall Boyle - PESI

1 × $30.80 -

×

Investment Banking Networking Toolkit By Breaking Into Wall Street

1 × $30.80

Investment Banking Networking Toolkit By Breaking Into Wall Street

1 × $30.80 -

×

Brilliancy: The Essence of Intelligence (Diamond Body Series) By Hameed Ali

1 × $6.00

Brilliancy: The Essence of Intelligence (Diamond Body Series) By Hameed Ali

1 × $6.00 -

×

Killer Referral Machine By Tom Poland

1 × $30.80

Killer Referral Machine By Tom Poland

1 × $30.80 -

×

Photography for Beginners By Josh Dunlop

1 × $30.80

Photography for Beginners By Josh Dunlop

1 × $30.80 -

×

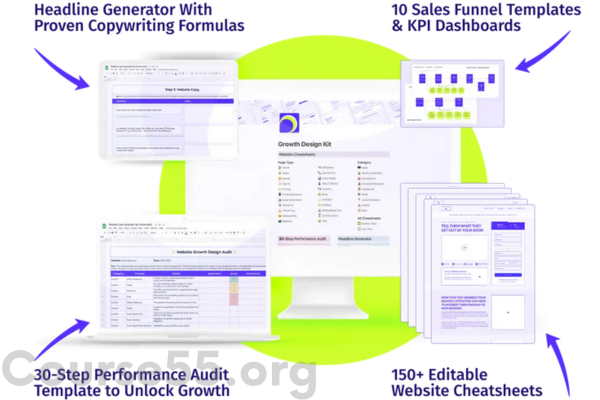

Growth Design Kit By Growmodo

1 × $30.80

Growth Design Kit By Growmodo

1 × $30.80 -

×

MY PEEPS With Travis Speegle

1 × $30.80

MY PEEPS With Travis Speegle

1 × $30.80

Vega Modified Butterfly Class By Jay Bailey – Sheridan Options Mentoring

$247.00 Original price was: $247.00.$30.80Current price is: $30.80.

SKU: C55org.46157kdYb8Wre

Category: Download

Tags: Jay Bailey, Sheridan Options Mentoring, Vega, Vega Modified Butterfly Class

Vega Modified Butterfly Class by Jay Bailey – Sheridan Options Mentoring: An In-Depth Review – Immediate Download!

Content Proof:

In the ever-shifting landscape of options trading, volatility often feels like an unpredictable storm. For traders eager to sharpen their skills and navigate this volatility with precision, Jay Bailey’s “Vega Modified Butterfly: A Deep Dive” offers a guiding light. Designed specifically for traders utilizing butterfly spreads—an effective strategy in range-bound markets—this course addresses the challenges of managing volatility risk. Coupled with the mentorship approach of Sheridan Options Mentoring, Bailey’s program stands out as a valuable resource for both beginners and experienced traders aiming to elevate their trading game.

This review explores the class structure, content, and real-world applications, while also unpacking the philosophy and methodologies underpinning the strategies taught. With supplemental materials and interactive sessions enriching the experience, this course delivers a hands-on, practical roadmap for mastering butterfly spreads amid market turbulence. By the end, traders will have tools to confidently capture profits, even when markets seem chaotic.

Course Breakdown

Core Curriculum

At its heart, the Vega Modified Butterfly course blends theoretical foundations with actionable tactics. Participants are guided step-by-step through the setup and management of butterfly spreads, particularly focusing on how implied volatility (IV) influences these trades. Bailey’s emphasis on understanding IV dynamics is pivotal—grasping this concept often separates successful trades from costly mistakes.

Core topics include:

-

Vega Sensitivity & Implied Volatility:

Traders learn how option prices react to shifts in IV, empowering them to make calculated entry and exit decisions. -

Trade Setups & Adjustments:

Detailed strategies are shared for selecting strike prices and expiration dates when constructing butterfly spreads. Bailey also stresses how to pivot and adjust positions as market conditions fluctuate, ensuring flexibility and control. -

Risk Management Techniques:

A significant portion of the curriculum is dedicated to safeguarding capital. Bailey provides concrete tools and frameworks to mitigate losses and optimize returns, especially when volatility spikes and markets become unpredictable.

Interactive Learning Components

In an age where information is plentiful but often overwhelming, this course excels in delivering well-organized, digestible content. Participants receive a variety of materials designed to support different learning styles:

-

On-Demand Video Modules:

Clear, structured video lessons allow learners to progress at their own pace and revisit key sections whenever necessary. -

Concise PowerPoint Summaries:

Visual learners benefit from slide presentations that distill the course’s main concepts into easy-to-reference formats. -

Live Q&A Sessions:

These interactive sessions provide direct access to Jay Bailey, enabling participants to ask questions and receive tailored advice. This engagement fosters a collaborative learning atmosphere, much like experienced traders sharing insights over coffee.

The Power of Mentorship

Expert Leadership

Jay Bailey brings years of hands-on experience to the table, lending authority and depth to the course. His mentorship focuses not only on strategy mechanics but also on cultivating a deeper understanding of market behavior and trader psychology. His guidance acts as a steady hand steering participants through volatile conditions, helping them avoid common pitfalls.

Additionally, contributions from Mark, another seasoned trader, enrich the learning experience. His expertise in hedging techniques and strategy refinement offers participants multiple perspectives, blending practical application with advanced insights. This dual mentorship approach encourages traders to develop resilient, well-rounded trading strategies.

Building a Trading Community

A noteworthy aspect of the course is the strong sense of community it fosters. Trading can often feel like a solitary pursuit, but within this program, participants connect with others facing similar challenges.

Benefits include:

-

Networking Opportunities:

Engaging with peers allows traders to exchange strategies, tips, and market observations in a supportive environment. -

Shared Learning:

Listening to fellow traders’ successes and hurdles offers fresh perspectives and actionable takeaways, accelerating collective growth.

Mastering Market Volatility

Understanding Market Forces

A central focus of the course lies in decoding how volatility behaves within the broader market context. Bailey stresses the importance of understanding what drives IV shifts—be it economic events, earnings reports, or shifts in investor sentiment. Rather than reacting impulsively to price swings, traders are encouraged to recognize the underlying forces at play.

Tools such as the VIX volatility index are introduced as essential instruments for gauging market sentiment and refining trading decisions. This big-picture perspective helps participants move beyond narrow price fixation toward a more strategic, informed approach.

Practical Implementation

To solidify understanding, the course provides real-world trading examples demonstrating how butterfly spreads can be adapted to different volatility environments. For instance, during earnings season—a time typically marked by heightened uncertainty—traders learn how to employ delta-neutral butterfly positions to capitalize on minimal price movement while keeping risk in check.

A key highlight is the use of sensitivity analysis, showing how varying levels of implied volatility impact the profitability of butterfly spreads:

| Implied Volatility | Break-Even Range | Maximum Loss | Maximum Profit |

|---|---|---|---|

| Low (<20%) | $X1 – $Y1 | $Z1 | $W1 |

| Medium (20%-30%) | $X2 – $Y2 | $Z2 | $W2 |

| High (>30%) | $X3 – $Y3 | $Z3 | $W3 |

This table helps traders visualize risk-reward dynamics and adapt their strategies based on prevailing volatility levels.

Final Thoughts

In summary, Jay Bailey’s Vega Modified Butterfly course stands out as an invaluable resource for options traders aiming to confidently tackle volatility head-on. By seamlessly blending theory with practical insights, the course arms traders with the knowledge and tools needed to navigate unpredictable markets skillfully.

The combination of expert mentorship, structured content, and a strong community element ensures that participants leave not just as better-informed traders, but as adaptable strategists ready to face market challenges. This course invites traders to rethink their approach, embrace volatility rather than fear it, and transform uncertainty into opportunity.

Frequently Asked Questions:

Business Model Innovation: We operate a group buying strategy, allowing participants to share costs and access popular courses at reduced prices. This model benefits individuals with limited financial resources, despite concerns from content creators about distribution methods.

Legal Considerations: The legality of our operations involves complex issues. Although we don’t have explicit permission from course creators to resell their content, there are no specific resale restrictions stated at the time of purchase. This ambiguity creates an opportunity for us to provide affordable educational resources.

Quality Control: We ensure that all course materials purchased are identical to those offered directly by the creators. However, it’s important to understand that we are not official providers. As such, our offerings do not include:

– Live coaching calls or sessions with the course author.

– Access to exclusive author-controlled groups or portals.

– Membership in private forums.

– Direct email support from the author or their team.

We aim to reduce the cost barrier in education by offering these courses independently, without the premium services available through official channels. We appreciate your understanding of our unique approach.

Be the first to review “Vega Modified Butterfly Class By Jay Bailey – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.