Introduction to Macro Investing By Mike Singleton

$599.00 Original price was: $599.00.$30.80Current price is: $30.80.

Introduction to Macro Investing: A Comprehensive Review of Mike Singleton’s Educational Program – Immediate Download!

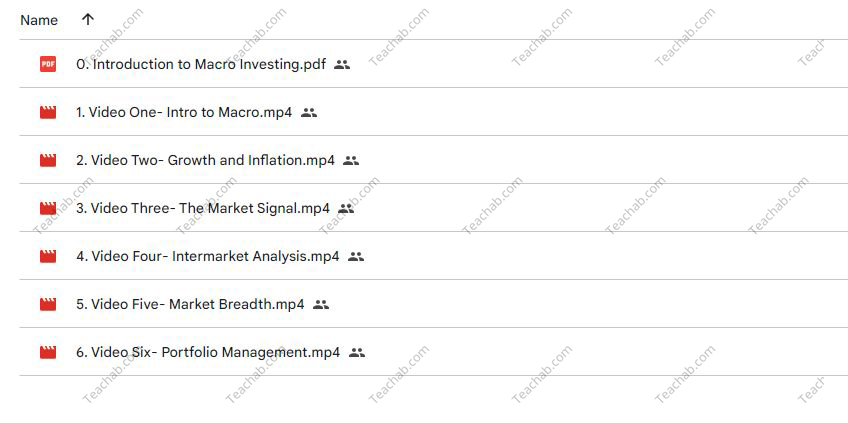

Content Proof:

In the dynamic world of finance, understanding macroeconomic trends and their impact on investments can feel like navigating uncharted waters. The complex interplay between economic indicators, market fluctuations, and investment strategies often overwhelms even experienced investors. Mike Singleton’s “Introduction to Macro Investing” seeks to simplify these complexities, offering a structured and engaging learning experience. This program, presented through a series of video lessons, equips participants with the necessary frameworks and analytical tools to interpret market behavior through a macroeconomic lens. Whether you’re a beginner or a seasoned investor, Singleton’s insights provide a valuable roadmap for making informed financial decisions. This review explores the course’s structure, Singleton’s teaching philosophy, and the broader significance of macro investing in today’s financial climate.

Course Structure and Content

The “Introduction to Macro Investing” program is organized into six video presentations, each ranging from 20 to 45 minutes. This modular approach allows participants to absorb the material at their own pace while accommodating different learning preferences. Each session builds on key macroeconomic principles, gradually shaping a cohesive understanding of the subject.

- Course Breakdown:

- Total Video Presentations: 6

- Duration per Video: 20-45 minutes

Singleton begins by laying a strong foundation in economic fundamentals, focusing on real economic growth, inflation, and monetary policy. These concepts serve as essential building blocks for more advanced discussions later in the course. By breaking down complex ideas into digestible segments, Singleton ensures that learners remain engaged without feeling overwhelmed.

A distinguishing feature of the course is Singleton’s ability to bridge theory with real-world applications. Through historical market analysis, case studies, and practical examples, he illustrates how macroeconomic forces shape investment outcomes. This approach makes macro investing more relatable and accessible, helping learners connect economic concepts to tangible financial decisions.

Singleton’s Teaching Philosophy

At the heart of Singleton’s approach is a commitment to making macroeconomic knowledge widely accessible. As the founder and senior analyst at Invictus Research, he brings both academic expertise and hands-on investment experience to his teaching. His background at institutions like Broad Run Investment Management informs his ability to break down intricate financial concepts in a way that resonates with investors at all levels.

Singleton’s philosophy is rooted in the belief that macroeconomic literacy shouldn’t be exclusive to hedge fund professionals or institutional investors. By democratizing this knowledge, he empowers retail investors to make better-informed decisions in the financial markets. His teaching method strikes a balance between fundamental analysis (examining the economic forces behind market movements) and technical analysis (interpreting market trends and price action). This dual perspective encourages participants to develop both critical reasoning and strategic intuition.

Core Macroeconomic Concepts Explored

The value of Singleton’s program lies in its ability to distill complex macroeconomic theories into actionable insights. Several fundamental principles form the backbone of the course:

- Real Economic Growth:

- Measures the increase in goods and services production, adjusted for inflation.

- Serves as a key indicator of economic health, influencing investor sentiment and asset valuations.

- Inflation:

- Defined as the rate at which prices for goods and services rise, eroding purchasing power.

- Affects interest rates, central bank policies, and overall investment strategies.

- Monetary Policy:

- Encompasses central bank actions to regulate money supply and achieve economic stability.

- Impacts interest rates, credit availability, and financial market conditions.

Importance of these Concepts

Understanding these core concepts lays a solid foundation for participants to interpret and analyze market data effectively. Singleton’s focus on real-world implications of these economic indicators empowers investors to respond proactively to market fluctuations, rather than reactively.

For instance, when inflation rates begin to rise significantly, an astute investor can anticipate potential changes in monetary policy, such as interest rate hikes by the Federal Reserve. This foresight may guide crucial decisions on asset allocation and risk management, enhancing the potential for investment success.

The Role of Invictus Research

“Introduction to Macro Investing” seamlessly aligns with Invictus Research’s core mission: delivering institutional-grade market analysis and educational resources at a price point that remains accessible to all investors. In an industry often marked by exclusivity and high costs, this commitment to affordability is particularly significant.

- Mission of Invictus Research:

- Offer top-tier research and educational tools to a broad spectrum of investors.

- Enhance retail investors’ understanding of market dynamics, equipping them to make informed financial decisions.

In a financial landscape where valuable insights are often behind steep paywalls, Singleton’s focus on education levels the playing field. His course provides participants not only with analytical frameworks but also with the confidence to navigate markets independently. This is crucial for those looking to bridge the gap between retail and institutional investing, traditionally dominated by those with access to superior research and resources.

Moreover, the course’s affordability and accessibility reflect a larger shift in financial education, moving away from exclusive, high-ticket training programs and toward inclusive, widely available learning opportunities. By democratizing macroeconomic knowledge, Invictus Research—through Singleton’s teachings—empowers a new wave of investors prepared to engage with financial markets more strategically.

The Practical Impact of Macro Investing

Macro investing extends beyond academic theory—it has direct, real-world applications that shape investment strategies and outcomes. Singleton underscores the importance of understanding macroeconomic forces to develop a clearer perspective on market trends and make well-informed investment choices.

- Key Investment Strategies Influenced by Macro Factors:

- Portfolio Allocation: Economic indicators help investors diversify assets intelligently based on expected market shifts.

- Risk Management: Awareness of macroeconomic trends allows investors to identify potential risks early and adjust strategies accordingly.

One of the key advantages of macro investing is its ability to provide a broader, more structured view of the financial markets. For example, during periods of economic contraction, an astute investor might shift focus toward defensive sectors such as healthcare and utilities, which historically demonstrate resilience in downturns. Conversely, in a strong economic climate, high-growth sectors like technology and consumer discretionary may present more lucrative opportunities.

Additionally, Singleton highlights the deep interconnection between global events and local markets. Economic shifts in one region can have ripple effects worldwide, reinforcing the necessity of adopting a global perspective when crafting investment strategies.

Conclusion: A Must-Have Resource for Investors

Ultimately, “Introduction to Macro Investing” by Mike Singleton stands as an essential educational tool for anyone looking to strengthen their understanding of financial markets. Through its well-structured video presentations, clear explanations of fundamental economic principles, and commitment to accessibility, the course addresses a crucial gap in financial education. Singleton’s ability to simplify complex macroeconomic forces enables investors to approach the market with greater confidence and strategic insight.

In today’s fast-evolving financial landscape, those equipped with a solid grasp of macroeconomics are better positioned to make sound investment choices and navigate market volatility effectively. For individuals eager to leverage macroeconomic insights to enhance their investing acumen, Singleton’s course offers a valuable and practical learning experience. With key concepts clearly outlined and a strong foundation provided, participants can step into the investment world with clarity, confidence, and a more refined approach to market analysis.

Frequently Asked Questions:

Business Model Innovation: We operate a group buying strategy, allowing participants to share costs and access popular courses at reduced prices. This model benefits individuals with limited financial resources, despite concerns from content creators about distribution methods.

Legal Considerations: The legality of our operations involves complex issues. Although we don’t have explicit permission from course creators to resell their content, there are no specific resale restrictions stated at the time of purchase. This ambiguity creates an opportunity for us to provide affordable educational resources.

Quality Control: We ensure that all course materials purchased are identical to those offered directly by the creators. However, it’s important to understand that we are not official providers. As such, our offerings do not include:

– Live coaching calls or sessions with the course author.

– Access to exclusive author-controlled groups or portals.

– Membership in private forums.

– Direct email support from the author or their team.

We aim to reduce the cost barrier in education by offering these courses independently, without the premium services available through official channels. We appreciate your understanding of our unique approach.

Be the first to review “Introduction to Macro Investing By Mike Singleton” Cancel reply

You must be logged in to post a review.

Getting Things Done Training Course | Crucial Learning By David Allen

Getting Things Done Training Course | Crucial Learning By David Allen

Reviews

There are no reviews yet.